The NAR Settlement Event: A New Chapter in Real Estate

Transforming Transactions: The NAR Settlement Ushers in a Fairer Real Estate Future

Welcome to my unique weekly article for the subscriber-only edition.

TL;DR: Jump directly to Item 13: Quick highlights.

Outlines and Key Takeaways

Introduction to the Event and Brief Overview

Background and History

Operational Excellence Application

Lean Enterprise Application

Status of Real Estate Company Stocks

Investment and Strategic Planning Related to AI

What's Next for the Real Estate Company

As a realtor, what should I do with the news of the NAR settlement?

As a real estate broker, what should I do with the news of the NAR settlement?

As a home seller, what should I do with the news of the NAR settlement?

As a home buyer, what should I do with the news of the NAR settlement?

As a first-time home buyer, what should I do with the news of the NAR settlement?

TL;DR: Quick highlights

Lesson learned

Conclusions

Introduction to the Event and Brief Overview

In a landmark decision, the National Association of Realtors (NAR) has reached a settlement regarding its realtor commission structures. This event marks a significant shift in the real estate industry, potentially transforming how realtor commissions are determined and impacting all stakeholders in the property market.

Background and History

For years, the real estate industry operated under a commission-based model, with percentages ranging from transaction to transaction but typically hovering around a standard rate. This model has faced criticism for its lack of transparency and flexibility, prompting legal scrutiny and calls for reform. The NAR, as a leading authority in the real estate market, has been at the center of these discussions, leading to the recent settlement.

By taking proactive steps to understand the implications of the NAR settlement, adapting business practices, and focusing on delivering value to clients, realtors can navigate the changes effectively and position themselves for success in a potentially evolving real estate landscape.

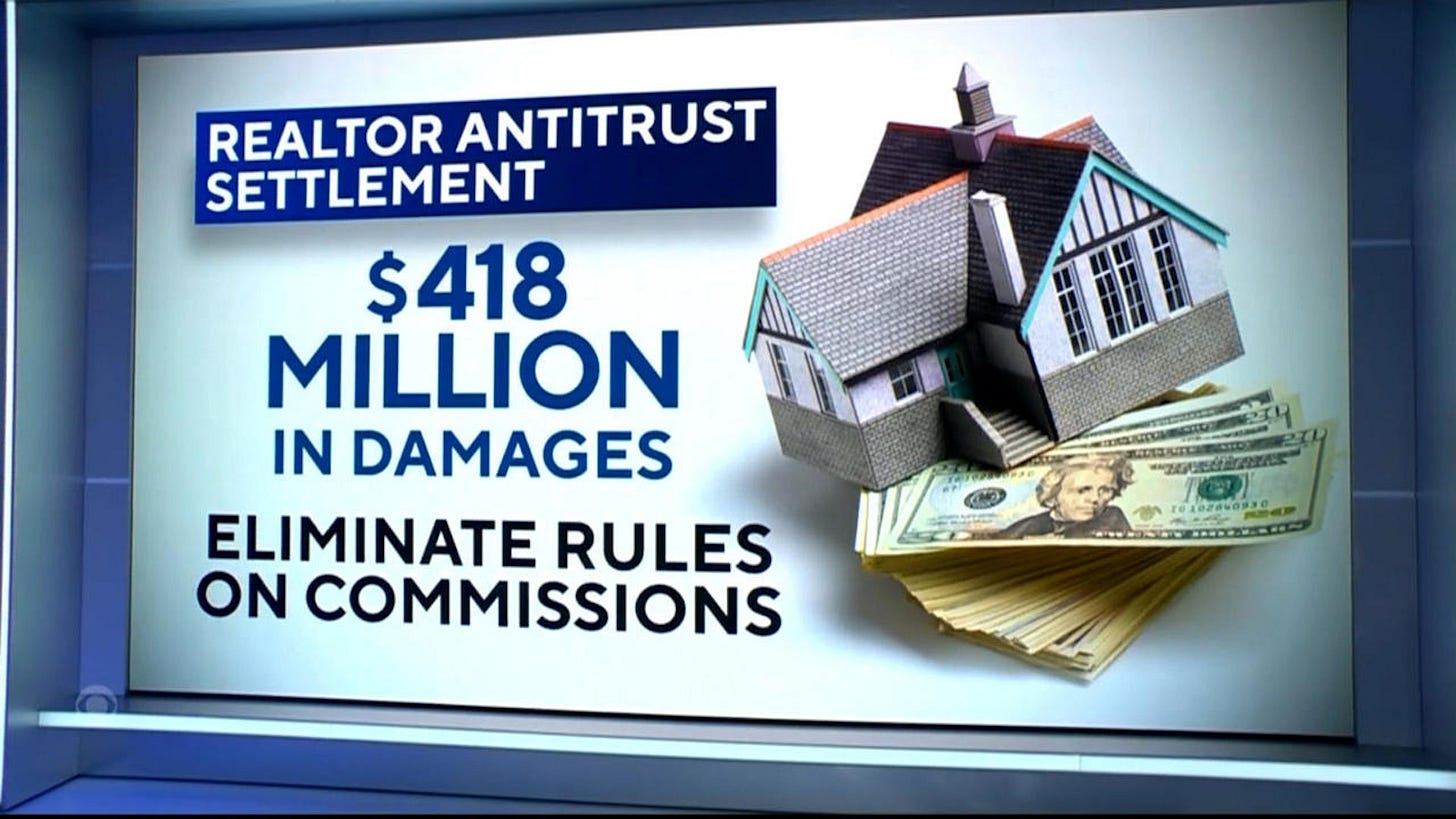

Landmark Legal Settlement: Home sellers and the real estate industry, involving the National Association of Realtors (NAR), agreed to a $418 million settlement over antitrust lawsuits related to real estate commissions.

Settlement Terms:

Home sellers to pay smaller commissions, keeping more sale proceeds.

Buyers to decide how much buyer’s agents are paid, shifting from seller-decided commissions.

Impact on Industry:

Significant changes for buyers, sellers, and real estate agents.

Transition period until mid-July when the settlement becomes effective.

Background of Lawsuits:

Originated from a federal class-action antitrust lawsuit, Burnett v. NAR, with a jury verdict favoring plaintiffs against NAR and large brokerages for inflating seller-paid commissions.

Settlement resolves over 20 similar federal cases, effective mid-July upon court approval.

Changes to Real Estate Practices:

Revised rules affect users of multiple listing services (MLS), including non-Realtors.

Elimination of cooperative compensation, preventing sellers from setting buyer’s agent commissions in MLS listings.

New Agent Compensation Models:

Buyers may set agents' pay through various models, promoting industry innovation.

Negotiation Complications:

Potential financial burden on buyers paying agents outside of settlement.

Agent compensation could become a negotiation point, possibly included in mortgage loans.

Immediate Effects for Buyers and Sellers:

Transition period involves buyers possibly signing contracts with agents on payment terms.

Sellers advised to consult agents for compliance with new rules, effective before the July implementation.

Operational Excellence Application

The settlement is expected to drive Operational Excellence within the real estate sector by encouraging more competitive commission rates and services. Realtors and brokers will need to reassess their value propositions, focusing on efficiency, customer service, and innovative solutions to remain competitive. This shift could lead to the adoption of new technologies and business models that prioritize client satisfaction and operational efficiency.

Lean Enterprise Application

Lean principles, which focus on minimizing waste and maximizing value, could see increased application in real estate practices post-settlement. Agencies might streamline operations, reduce overhead costs, and enhance service delivery. This approach will not only benefit consumers through potentially lower commission rates but also bolster the industry's sustainability by fostering a culture of continuous improvement and value creation.

Status of Real Estate Company Stocks

The announcement of the settlement has likely had an immediate impact on the stock market, particularly for publicly traded real estate companies. Investors are advised to closely monitor these developments, as shifts in commission structures could affect profit margins, revenue forecasts, and overall market competitiveness.

Investment and Strategic Planning Related to AI

In response to the settlement, real estate companies may accelerate their investment in AI and other technologies. Strategic planning could focus on leveraging AI for market analysis, personalized customer service, and operational automation. These investments aim to enhance efficiency, reduce costs, and create differentiated offerings in a more competitive market.

What's Next for the Real Estate Company

For companies impacted by the settlement, the next steps involve aligning business strategies with the new regulatory environment. This may include revising commission models, investing in technology, and reevaluating market positioning. Companies will need to navigate these changes while maintaining service quality and competitiveness.