SBA, SCORE, and SBDCs Explained: 3 Essential Local Resources for Small Business Owners

How SBA, SCORE, and SBDCs Provide the Support You Need to Start, Grow, and Thrive in Business

Welcome to my unique weekly article for the Paid subscribers-only edition.

Outlines and Key Takeaways

Why Small Business Owners Need These Resources

What are SBA, SCORE, and SBDCs?

How These Resources Benefit Small Business Owners

Recommendations for Small Business Owners and Startup Founders

A detailed list of business support solutions offered by the Small Business Administration (SBA) for Small and Medium Enterprises (SMEs)

A detailed list of business support solutions offered by the SCORE for Small and Medium Enterprises (SMEs)

A detailed list of business support solutions offered by the Small Business Development Centers (SBDCs) for Small and Medium Enterprises (SMEs)

Conclusion

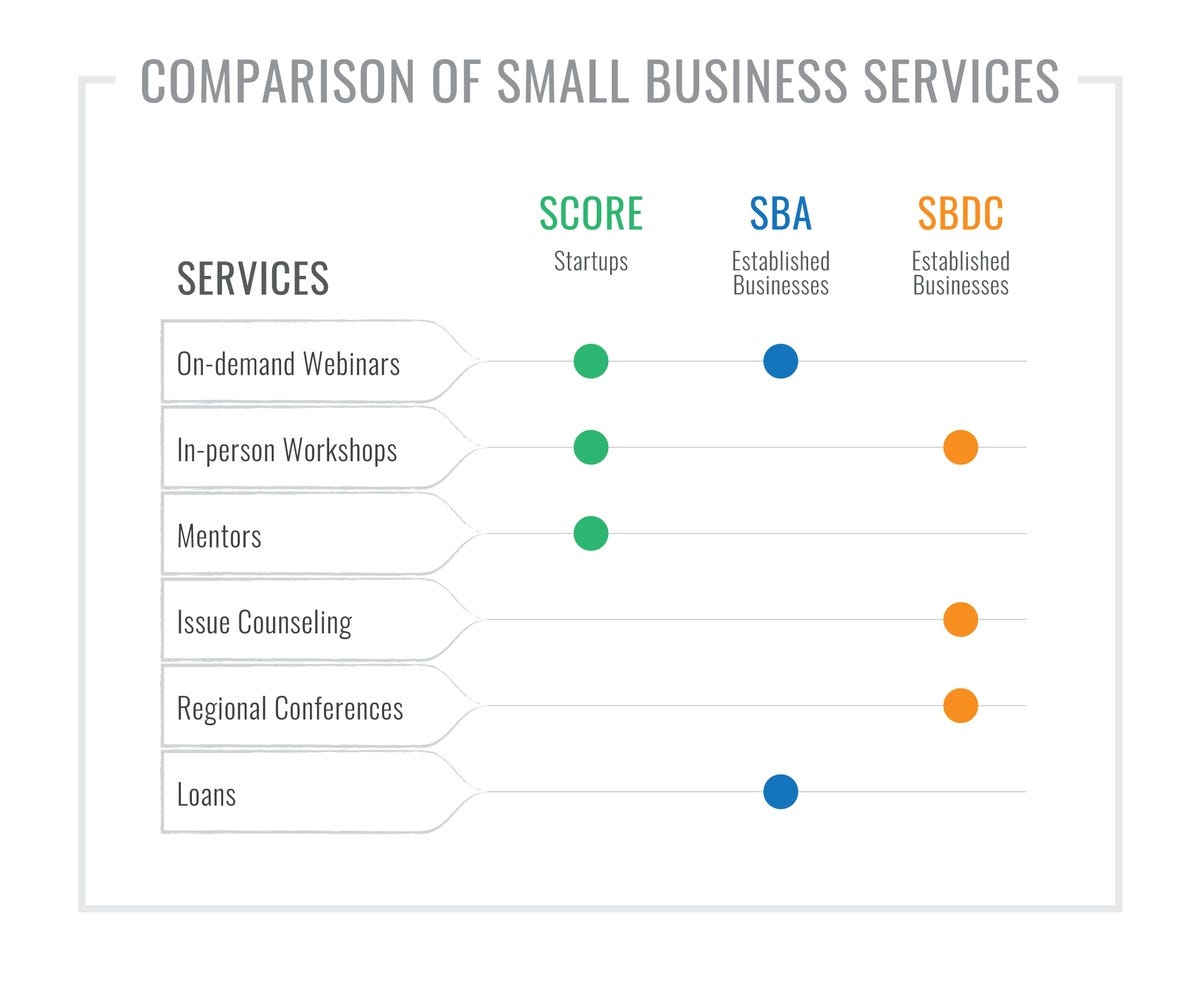

Why Small Business Owners Need These Resources

Starting and running a small business can be overwhelming, especially for new entrepreneurs who may lack experience in areas like financial management, strategic planning, or market research. For many, navigating the complex world of business ownership can feel isolating. Fortunately, small business owners in the U.S. have access to several invaluable local resources that offer support and guidance: the Small Business Administration (SBA), SCORE, and Small Business Development Centers (SBDCs). These organizations help entrepreneurs with various aspects of running a business, from securing financing to offering mentorship and education. Understanding what each organization does and how to leverage their services can make a significant difference in the success of a small business.

What are SBA, SCORE, and SBDCs?

SBA (Small Business Administration):

The SBA is a federal agency established in 1953 to promote the economy by providing assistance to small businesses. The SBA does not directly lend money but works with various lenders to provide government-backed loans to small businesses, reducing the risk for lenders and giving small business owners access to capital. In addition to loans, the SBA offers various educational programs, disaster assistance, and government contracting resources.

SCORE (Service Corps of Retired Executives):

SCORE is a nonprofit organization associated with the SBA, consisting of volunteer mentors, many of whom are retired business professionals or executives. SCORE offers free business mentoring, workshops, and educational resources to small business owners at any stage of their journey. The organization pairs entrepreneurs with experienced mentors who can offer personalized guidance and advice.

SBDCs (Small Business Development Centers):

SBDCs are a nationwide network of local centers that offer free or low-cost consulting and training to small business owners and aspiring entrepreneurs. Funded by the SBA, universities, and state governments, SBDCs provide a range of services, including business plan development, financial analysis, and market research. With over 900 locations across the U.S., SBDCs are easily accessible and are an excellent resource for entrepreneurs seeking hands-on assistance in growing their businesses.