Welcome to my unique weekly article for the paid subscriber-only edition.

Outlines and Key Takeaways

Introduction

Founders and Board of Directors (BOD)

Background and History

Business Model

Unique Selling Proposition (USP)

Segmentation, Targeting, Positioning (STP)

What’s Next?

Lessons Learned and Conclusions

From humble beginnings in Kentucky to becoming a dominant force in American retail, Dollar General is more than a dollar store—it's a rural economic engine.

🏪 Introduction

Dollar General isn’t just a discount retailer—it’s a force in American retail logistics and rural access. With over 19,000 stores across 47 states, it thrives where big-box giants don’t reach. Built on simplicity, speed, and efficiency, Dollar General’s model shows how lean strategy can unlock billions.

👥 Founders and Board of Directors (BOD)

Founded in 1939 by James Luther Turner and Cal Turner Sr., the business began as a wholesale venture before transforming into Dollar General in 1955. The Turner family’s legacy is still visible in the company’s culture. Today, the board includes executives with backgrounds from Walmart, PepsiCo, and Amazon—reinforcing its strategic positioning.

🏛️ Background and History

Starting with a single store in Kentucky, Dollar General's concept was revolutionary: nothing over $1. By the 2000s, the business had evolved, with its pricing expanding but its mission unchanged—serve value-conscious customers in small-town America. In 2007, private equity firm KKR took it private, then re-listed the company in 2009. Since then, growth has accelerated, particularly through store density and product breadth.

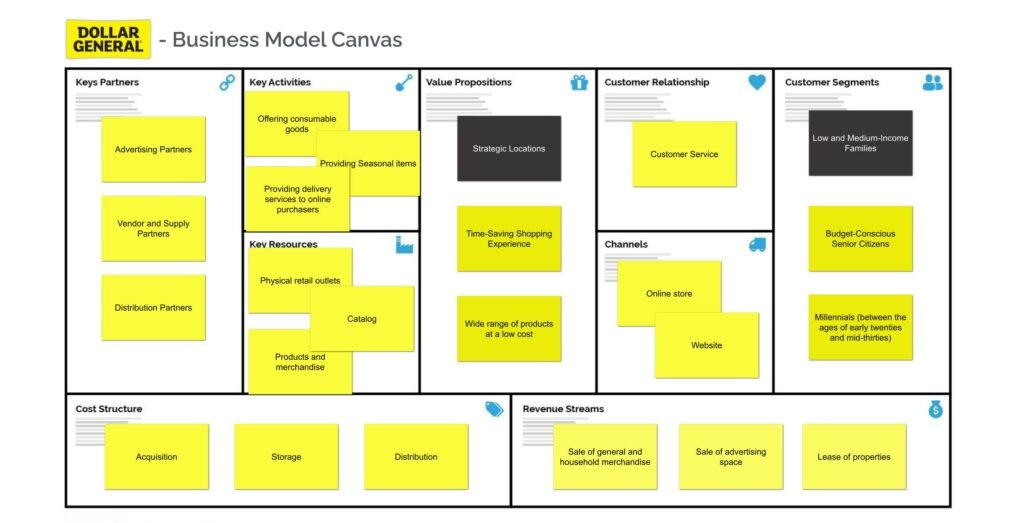

💼 Business Model

Dollar General’s business model is grounded in operational efficiency and limited SKU assortments. Most stores are 7,000–10,000 square feet—half the size of traditional retailers—allowing for quick construction and lower rent. The model focuses on high-turnover items: groceries, household essentials, and seasonal goods. Many stores operate with just two to three employees per shift, further cutting costs.

The company owns and operates nearly all locations (unlike franchise models), maintaining tight control over supply chain, store formats, and inventory.

🎯 Unique Selling Proposition (USP)

“Save time. Save money. Every day.”

Dollar General’s USP isn’t just affordability—it’s convenience. Most stores are within a five-minute drive for rural residents. Customers shop quickly, often spending $10 or less per visit, but doing so frequently. This convenience-first model turns low-ticket shoppers into loyal weekly visitors.

Additionally, the company has introduced DG Fresh (its in-house distribution for perishables) and pOpshelf (a new format targeting suburban shoppers with slightly higher-end items), proving its agility in meeting diverse needs.

🧭 Segmentation, Targeting, Positioning (STP)

Segmentation: Rural and low-to-middle-income customers

Targeting: Households seeking essentials with limited retail access

Positioning: Dollar General is positioned as the most convenient, affordable store for everyday needs—serving as both a mini-grocery and general store in one.

The brand’s private label portfolio (Clover Valley, DG Health, DG Home) further boosts margins while building customer loyalty.

🔮 What’s Next?

Dollar General plans to open over 800 new stores annually. It continues investing in self-distribution, technology upgrades, and international expansion (its first stores in Mexico opened in 2023). AI-driven demand planning, ESLs (electronic shelf labels), and mobile app enhancements signal that even a lean business can embrace tech smartly.

The company is also focused on labor investment—offering new pathways for training, upskilling, and leadership development to address staffing challenges.

📘 Lessons Learned and Conclusions

Underserved markets are opportunity-rich: Dollar General proves that retail success doesn’t rely on metro markets alone.

Lean wins: Its small-store model, limited SKUs, and low overhead are a masterclass in efficient operations.

Data + Execution = Edge: From localized merchandising to dynamic pricing, Dollar General integrates tech and field insight effectively.

Private labels matter: Developing in-house brands gives both margin control and brand equity.

Consistency scales: Standardized operations allow rapid expansion without loss of quality or brand promise.

💬 Final Thought

Dollar General isn’t flashy—but that’s the point. It wins by doing the basics extraordinarily well. As markets shift and margins tighten, its playbook is one worth studying by anyone interested in retail, cost leadership, or community-driven growth.

💬 Stay tuned as #BizDecoded dives into more brands that define success.

BIZDECODED - behind the brand - inside the money machine

🚨 Don’t Miss Out – Register Now

📍 Live Sessions Every Wednesday + Saturday

🕚 11:00 AM CST | Starting August 2025

🎥 Real brands. Real lessons. Real business transformation

🎟️ Full Access: $799

🎟️ Loyal Fans: $50 discount

🎟️ AMA Roadtrip Alumni: $100 discount

📽️ Recap Only: $399 (recordings + articles)

🚀 Register Now – Early Bird Discount Ends Soon!

Seats are limited for the live experience.

Sign up today to lock in the $599 early bird rate and secure your front-row seat to 20 powerful sessions with DBA John Ngo – a rare voice of authority who combines theory, action, and field expertise like no one else.

This is where brands are decoded.

This is how you level up.

Welcome to BizDecoded: Behind the Brand – Inside the Money Machine.

Exclusively on BizInsider.

🔗 Reserve your spot now – these are the brand insights you can’t Google.

👉 Join the program now!

#DollarGeneral #RetailSuccess #LeanStrategy #RuralMarkets #BizDecoded #PrivateLabel #OperationalExcellence #BizInsider